*Corrected* #KWS Keywords Studios

The world leader (by far) in outsourced services for the video game sector. Access to several layers of structural growth, at a discounted valuation caused by misguided fears

#KWS Keywords Studios - 1800p

DESCRIPTION

Keywords Studios began its earliest stage of life providing translation services to various tech companies, and later brought in Andrew Day who refocused the company’s strategy specifically on translation and localisation work for the video game sector. From this initial video gaming foothold the company broke into video game testing, and then gradually into various adjacent areas of video game outsourcing spend. The company is now a one-stop-shop for outsourced content creation and post production tasks in the video game sector

Keywords’ growth comes from a combination of high organic growth (over 10% revenue CAGR guided to continue into the medium/long term), supercharged by an aggressive acquisition strategy

The company works with 24 of the top 25 games companies by revenue. See the logos in the image below.

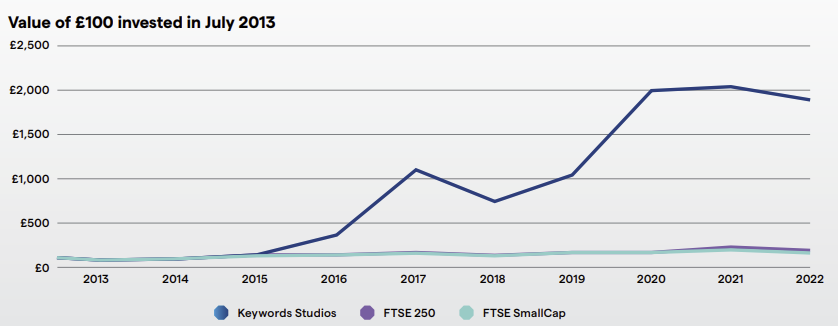

The track record of shareholder returns has dwarfed its benchmarks since IPO in 2013, as per chart below

Two insider buys in May and June 2023 at 2132p and 1850p respectively, although the latter may be motivated by the new CEO needing to keep up with minimum holding requirements.

Insider dealing detail since start of 2023

A generally positive pattern, despite Jon Hauck’s sale upon option excercise

INVESTMENT CASE

The simple bull case on Keywords studios is that the current juncture offers an amazing buying opportunity into a long term quality “compounder” stock. Buying into such long term growth stocks at a moment of temporary weakness is one of the most reliable methods to achieving above market returns over the long term

More detail on the investment case

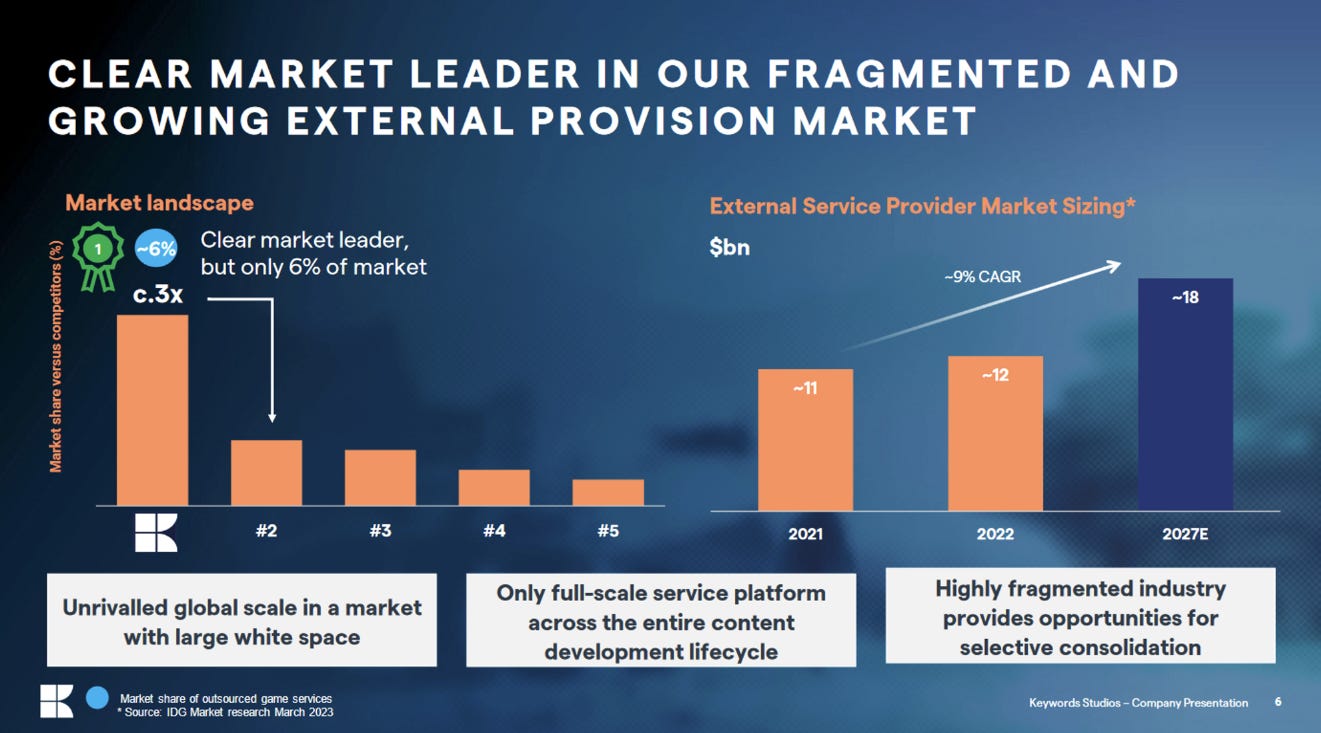

Keywords is the world leader in outsourced services for the video game sector, benefiting from several layers of structural growth stacked upon each other - a growing video game market, within which there is growth in the portion of video game cost base which is being outsourced, within which Keywords itself is the market leading outsource provider with consistently growing market share. Hence, there are three layers or drivers of revenue growth

The outsource market for video game content creation services is growing at a c9% CAGR. Within this outsourced market, Keywords is 3x larger than the next biggest provider, and has been consistently growing its market share

Despite this, Keywords still has just 6% share of the outsourced video game content market, leaving a hugely fragmented market to expand into both organically and via acquisition

And there is even an important fourth driver of long term structural growth emerging lately…